The Only Guide to Private Wealth Management copyright

The Only Guide to Private Wealth Management copyright

Blog Article

The Of Independent Financial Advisor copyright

Table of ContentsIndependent Financial Advisor copyright Can Be Fun For AnyoneWhat Does Tax Planning copyright Do?9 Simple Techniques For Independent Financial Advisor copyrightUnknown Facts About Financial Advisor Victoria BcRumored Buzz on Lighthouse Wealth ManagementHow Investment Representative can Save You Time, Stress, and Money.

“If you're to buy a product or service, say a television or some type of computer, you would want to know the specs of itwhat tend to be their parts and just what it can perform,” Purda explains. “You can consider purchasing economic advice and support in the same manner. Men And Women need to find out what they're buying.” With financial advice, it is vital that you understand that the merchandise isn’t bonds, shares or any other opportunities.it is things such as cost management, planning for retirement or paying off personal debt. And like getting a pc from a trusted company, people need to know they truly are purchasing economic advice from a dependable professional. Certainly Purda and Ashworth’s most fascinating results is approximately the costs that financial coordinators cost their customers.

This held true irrespective the charge structurehourly, commission, possessions under control or flat rate (into the research, the dollar value of costs was similar in each situation). “It however comes down to the worthiness idea and anxiety throughout the consumers’ part that they don’t know very well what they might be getting in trade for those charges,” says Purda.

The Greatest Guide To Financial Advisor Victoria Bc

Hear this informative article When you listen to the expression economic specialist, what pops into their heads? Many people remember a specialized who is able to give them economic information, specially when it comes to investing. That’s a good place to begin, but it doesn’t decorate the picture. Not really near! Economic analysts will people who have a bunch of other cash goals also.

A financial specialist can help you develop wealth and protect it for the lasting. Capable estimate your personal future financial needs and strategy methods to extend your own pension cost savings. They could additionally counsel you on when to begin making use of personal safety and ultizing the income inside retirement accounts so you can stay away from any awful charges.

Some Known Details About Independent Investment Advisor copyright

They're able to support determine just what mutual funds tend to be right for you and show you how to handle and then make the quintessential of your own opportunities. They are able to also make it easier to comprehend the dangers and what you’ll ought to do to obtain your goals. An experienced expense professional will also help you stay on the roller coaster of investingeven if your opportunities take a dive.

Capable provide you with the guidance you ought to create plans to make fully sure your wishes are performed. And you can’t put an amount label about reassurance that accompanies that. According to a recent study, the common 65-year-old couple in 2022 needs about $315,000 stored to pay for healthcare expenses in your retirement.

Rumored Buzz on Tax Planning copyright

Since we’ve gone over just what financial experts would, let’s dig into the different kinds. Here’s a guideline: All monetary coordinators tend to be economic experts, however all analysts tend to be coordinators - https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1706079058&direction=prev&page=last#lastPostAnchor. A financial coordinator concentrates on assisting people generate intends to reach long-lasting goalsthings like starting a college investment or saving for a down payment on a property

How do you know which financial advisor suits you - https://www.quora.com/profile/Carlos-Pryce-1? Listed below are some things you can do to make certain you are really employing ideal individual. Where do you turn when you've got two terrible options to select from? Easy! Find more solutions. The greater amount of possibilities you really have, a lot more likely you are which will make a good choice

The Ultimate Guide To Tax Planning copyright

The Intelligent, Vestor system can make it simple for you by revealing you around five monetary analysts who are able to last. The good thing is actually, it is totally free for related to an advisor! And don’t forget to get to the interview prepared with a list of concerns to inquire about in order to decide if they’re a great fit.

But pay attention, because a specialist is actually wiser as compared to typical keep doesn’t let them have the right to let you know what direction to go. Often, advisors are loaded with on their own since they do have more degrees than a thermometer. If an advisor begins talking down to you, it's time for you suggest to them the door.

Keep in mind that! It’s important that you and your monetary expert (anyone who it eventually ends up getting) take the exact same web page. You want an expert having a long-term investing strategysomeone who’ll encourage that hold investing link constantly whether or not the market is upwards or down. independent financial advisor copyright. Additionally you don’t like to use somebody who forces one buy something’s also risky or you are not comfortable with

About Ia Wealth Management

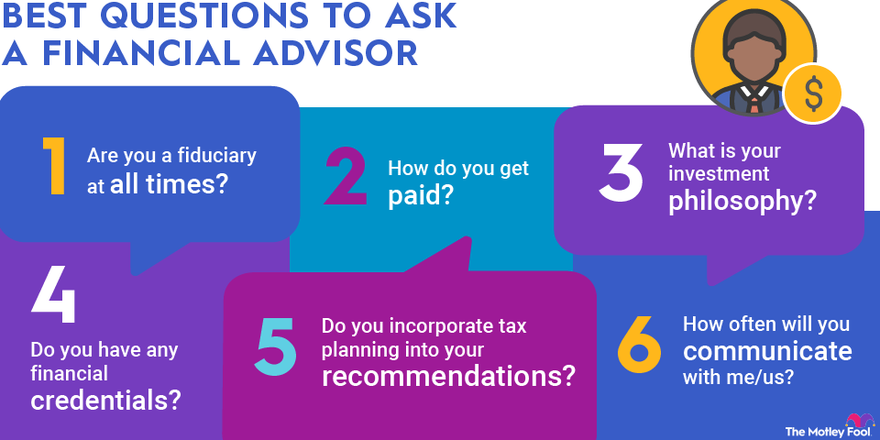

That combine provides you with the diversity you'll want to effectively spend for all the longterm. Because study economic advisors, you’ll most likely come across the term fiduciary task. All this means is actually any expert you employ must work such that benefits their own client and not unique self-interest.

Report this page